What I learned from trying to start a climate startup

First Trial of Climate Startup

This post was written on December 25, 2024 and serves as a year-end retrospective. From August 2023 to June 2024, I prepared to launch a climate startup.

My dream is to solve the climate crisis. I thought there was a better chance of solving it with business than politics. I still haven’t changed my mind about this.

The business model I tried this time came to me while I was serving in the republic of korea airforce in 2019. I left a company named Waddle, where I was a co-founder, to try to validate this idea.

It didn’t work out. I write about what I tried and what I learned. I also write what my plans are going forward.

Background Knowledge is required to understand this article

There’s a thing called carbon credits

Let’s put it simply.

First, the government sets a carbon emissions quota for economic entities. For example, Company A is required to emit 100 tons of carbon this year. Company B is also required to emit 100 tons, but A works hard and only emits 95 tons this year. B emits 110 tons. Then, A can sell 5 tons of carbon rights. B has to buy 10 tons of rights to emit carbon.

The Emission trading system aims to cap and reduce a country’s overall emissions. It encourages companies to reduce their carbon emissions and promotes technological innovation.

The largest market for carbon credits is in Europe. California is also a large market. Korea is a market that is expected to have a very high demand for carbon credits because Europe has enacted a carbon border transaction tax (CBAM), which requires steel, cement, fertilizer, and aluminum companies to report their carbon emissions and pay a tariff in order to sell goods to Europe. The United States and the United Kingdom are preparing similar systems. An easy way for companies in Korea to prepare for this is to buy carbon credits.

There are three types of carbon credits: carbon removal credits, carbon reduction credits, and carbon avoidance credits. They differ in what counts as a carbon reduction. Carbon removal credits are the most expensive one. 300-800 USD. Carbon avoidance credits range from 10-30$ per ton. Recently, carbon removal credits have been in demand due to carbon avoidance credit’s lack of clarity on carbon reductions. I wanted to issue carbon removal credits.

To solve the climate crisis, we need to capture and sequester greenhouse gases in the atmosphere - it’s the only way

Global warming refers to the increase in global temperatures due to increased greenhouse gases (primarily carbon dioxide, methane, and nitrous oxide) in the atmosphere. Of the greenhouse gases, carbon dioxide has the highest impact on climate change, with methane also contributing significantly.

What can we do to solve the climate crisis? We need to reduce the greenhouse gases in the atmosphere. To do this, we need to capture them and sequester them somewhere so they don’t go back into the atmosphere. Sequestration is important. This can be done by trapping greenhouse gases in the ground or under the ocean. So simply eating seaweed doesn’t help solve the climate crisis because while it captures greenhouse gases as it grows, it releases them back into the atmosphere as we eat and digest it. Of course, eating seaweed is better for the climate than eating beef. Because beef produces greenhouse gases when it’s raised.

There Is Something Called Biochar

When you thermally decompose wood at high temperatures in an oxygen-deprived environment, you produce charcoal. Similarly, various types of biomass (such as agricultural waste and forestry byproducts) can be converted into biochar by subjecting them to high temperatures (300–800°C).

The biochar produced in this way is a carbon-based solid material much like charcoal. It features a porous structure with strong adsorption capabilities and is highly stable, resisting decomposition. Consequently, when biochar is buried in the soil, it can sequester carbon from the atmosphere for hundreds to thousands of years. This method is also a well-known approach for earning carbon removal credits.

I Took on This Challenge

The Idea I First Had in 2019 – Microalgae

Microalgae generally refer to very small algae, primarily a type of phytoplankton. You’ve likely heard of them in the context of the marine food chain, right? In the ocean, the food chain follows a sequence: phytoplankton → zooplankton → small fish → larger fish.

These phytoplankton produce over 50% of the Earth’s oxygen through photosynthesis. Photosynthesis is the process of absorbing carbon dioxide and releasing oxygen while synthesizing energy.

So, if we were to build a massive automated facility to cultivate phytoplankton on a large scale, wouldn’t that capture an enormous amount of greenhouse gases? And if we could manufacture high-value products from the cultivated phytoplankton, wouldn’t that also be profitable? This was the idea that first came to mind. 🙃 I then organized my thoughts, resolved to try it someday, and developed a five-year plan to make it happen.

November 2023: Transitioning to Seaweed and Assessing Seaweed Farms

Starting in August 2023, I began exploring whether a microalgae-based business could actually work, meeting with numerous microalgae researchers along the way. The conclusion was clear: a business based on microalgae is unfeasible—at least with current technology. The reasons are as follows:

- Low Yield: The amount of microalgae that can be harvested from 1 liter of water is extremely small. For instance, during the summer, the so-called “green algae latte” from the Nakdong River yields only about 0.3 grams per liter, while lab environments can achieve roughly 3 grams per liter. However, my calculations indicated that to make the business economically viable, a yield of at least 10 grams per liter would be necessary. Increasing the yield through genetic modification also presents significant challenges.

- Separation Challenges: Separating microalgae from water is difficult. Microalgae are approximately 2 micrometers in size, whereas common fine dust particles are around 10 micrometers. Isolating such tiny particles requires extremely expensive centrifuges or filters. Even if high-value products can be produced from the separated microalgae, the cost of separation remains a major hurdle.

- Temperature Sensitivity: Microalgae thrive best at temperatures around 20–25°C. In South Korea, where the four seasons are distinct, maintaining such a temperature year-round would incur high heating costs.

For these reasons, by November 2023, we internally concluded that a microalgae-based business was not viable. The next area of investigation was seaweed, which ranks just behind microalgae in terms of efficiency of greenhouse gas sequestration per unit area and time through cultivation.

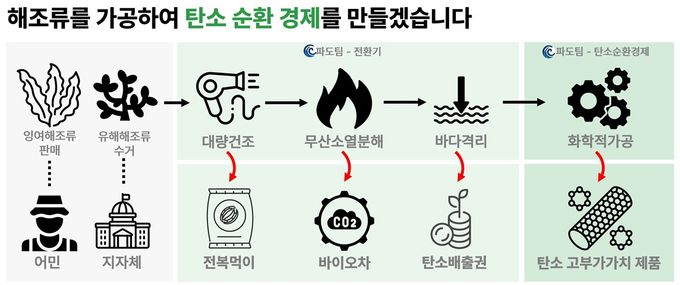

Initially, I planned to pursue both seaweed farming and processing. However, I decided to narrow the focus and concentrate solely on producing high-value products through seaweed processing. The strategy was to create biochar from seaweed to sequester carbon and generate initial revenue by issuing and selling carbon credits. With that revenue, the business could expand by developing carbon-based products like carbon frames or carbon electrodes. To gain a better understanding of seaweed farming, I even visited a seaweed farm and spent a week working there.

Business Model Validation – Carbon Removal Credits

After visiting a seaweed farm, my confidence in the business model grew significantly because I gained a clearer understanding of the seaweed cultivation market. Here’s the business model I envisioned. I purchase seaweed varieties such as miyeok and dasima at a low cost from local fishermen. This seaweed is then converted into biochar, which is sunk to the ocean floor to sequester carbon. The sequestered carbon is registered as carbon removal credits and sold to companies. Given that these credits currently trade for about $300 to $800 per ton, the revenue generated can be reinvested into researching and developing high-value, carbon-based products like carbon electrodes. Ultimately, this approach aims to establish a sustainable carbon cycle economy.

For this plan to work, it is essential to first register the carbon removal credits and secure the necessary facilities to produce biochar. Both of these are based on existing technologies and, in many ways, are straightforward to implement. To better understand the registration process for carbon removal credits, I met with a representative from EcoEye, a company active in the domestic carbon credit market, to learn about the issuance process. As for the biochar production equipment, it is already available on the market—even though it is expensive, it can be acquired. The next crucial step is funding.

Seed Investment Attraction

In fact, I had already been applying for various support programs. I submitted applications for the Preliminary Startup Package, Eco-Startup, and Startup-Centric University projects. I even participated in competitions such as the Hult Prize and the Environmental Startup Competition, and met with several VCs. However, nothing panned out. This process felt like a period of relentless self-scrutiny and refinement, but it was also a time of valuable learning.

- Despite being labeled “climate tech,” it’s essentially manufacturing. It operates on a completely different logic than the IT sector.

- Looking back at everything I had prepared, even I wouldn’t have invested in my own project. Nothing was validated, and I felt uneasy because there was simply nothing in place.

- The biggest reason for this was that the business I was preparing was rooted in manufacturing.

- I lacked essential elements like a factory site, equipment, and even any differentiated technology to build such equipment. Yet, these are fundamental requirements for starting a manufacturing business.

- Having come from an IT startup background, I was woefully unprepared for these aspects.

- VCs are fundamentally skeptical of carbon credit-based business models.

- It seems that carbon credit-based business models had been popular in the past, but most of them did not succeed.

- The carbon credit market is still in flux and heavily dependent on government policies. In fact, with recent factors akin to a state of war, there’s a widespread perception that there isn’t even time to worry about such matters.

- As a result, a business model that relies solely on carbon credits was not viable.

- I had an arrogant mindset—I thought I was someone, but I wasn’t.

- Honestly, I thought that having experience as a startup co-founder would guarantee some success, but that wasn’t something I could really boast about.

- Wandering around as the representative of a venture felt like being exposed and vulnerable out in an open field.

- I was deeply embarrassed when, confronted with sharp and necessary questions, I found my answers to be inadequate.

- It’s not Venture Capital. It’s just Capital.

- The same applies to support programs. Even so-called impact funds were no different. Although there was a belief that businesses addressing social issues might have a slightly higher chance, the focus remained rigidly on profitability.

- I began to feel disillusioned. Being offered 100000 to 200000 USD for a 10% equity stake, along with the promise of time and effort, seemed inefficient. I concluded that it would be better to earn that money myself. It makes sense to attract large amounts of capital only when scalability is a priority, but at this stage, taking on investment didn’t hold much meaning for me.

All of these lessons led me to the conclusion that launching the business immediately wasn’t a rational decision. And that realization has guided my current decision.

What I Learned

If You Have a Purpose, There Are Many Willing to Help – Don’t Hesitate to Ask for It

During this period, I received help from so many people. I want to remember each one, so I’ve recorded their contributions here. Thank you sincerely for taking the time to listen to my story despite your busy schedules. I will always remember your support.

- Collaborators

- Hye-Young Jo: Thank you for being with me through the transition from microalgae to seaweed. I’m grateful for the time you dedicated to me during such an uncertain period.

- Accelerators

- Ho-Geon Lee: You were the only one who looked favorably upon the carbon credit market, even introducing me to EcoEye. Your insightful words helped me see farther ahead. Thank you very much.

- Ye-Re Kim: I can always trust you and speak my heart openly. Thank you for helping me check in with my own feelings.

- Cheol-Hyun Yoo: Our connection from Bon Angels provided me with meaningful perspectives during moments of instability.

- Company

- Ji-Hyuk Park and Yong-Won Cho: I’m incredibly grateful for your clear and honest questions, even after working together. Truly, nothing could be more appreciated. I continue to cheer for the success of Gentoo.

- Ye-Bin Hwang: While you’re busy developing autonomous driving modules for agricultural machinery at Agmo, you always help me without hesitation when I need it. I’m both sorry and thankful for your constant support.

- *** : Thank you for sharing so many insights and giving me the courage to move forward as a fellow entrepreneur.

- Jun-Ho Geum: At Seawith, he is using seaweed blocks to produce lab-grown meat. Although you don’t use seaweed extensively now, I learned many valuable insights regarding seaweed processing.

- Wan-Young Cha: Your steady passion and bold spirit at Marine Innovation, where you’re developing biodegradable materials to replace plastics with seaweed, have been truly inspiring.

- *** : Your guidance allowed me to understand the time and budget requirements for issuing carbon credits. Thanks a lot.

- Tae-Yoon Park: I learned a great deal about the mindset of early-stage founders and the preparations needed to launch a business with the right machinery and equipment.

- Ji-Hyun Yoon: As someone selling smart recirculating aquaculture systems at AquaPro, and having already explored many avenues with microalgae, your input helped me decide that microalgae wouldn’t work for this business. I sincerely thank you, senior entrepreneur.

- Researchers

- *** : Your research on microalgae at Hanyang University helped me gain a better understanding of genetic improvement in microalgae.

- *** : I learned a great deal about abalone feed. Thank you for explaining everything so thoroughly and kindly.

I Was the Biggest Shortcoming

I thought I had prepared quite a bit, but in the end, the biggest shortfall was me. I don’t know how other founders feel, but I only engage in ventures where I see a chance to win. I evaluate every possibility I can think of before starting. I believed I was ready, but once I began, I realized I was far from being prepared. That realization was both painful and incredibly embarrassing.

Even now, I feel embarrassed. Yet, I still believe that someone must take on the challenge of solving the climate crisis through direct air capture (DAC)-based businesses. That’s why I plan to take what I’ve learned from these struggles and prepare once again.

Various Thoughts on Climate Entrepreneurship

There’s a Green Paradox

- In Bill Gates’ book <How to Avoid a Climate Disaster>, he introduces the concept of the Green Premium. For example, if an electric car costs more than a fossil fuel car, that price difference is the Green Premium.

- Bill Gates argues that tech startups need to work on reducing the Green Premium.

- One of the most effective ways to raise capital while lowering the Green Premium is through carbon credits. However, I must admit that the concept of carbon credits still confounds me. I’ve lost count of how many times I’ve explained carbon credits whenever I meet someone for the first time.

- Yet, if we disregard carbon credits when designing a business model, two fundamental problems arise. Naturally, it becomes much harder to overcome the Green Premium. More importantly, because carbon credits are a measure of the extent to which we contribute to the climate crisis, Hindering carbon credits can actually hinder our progress in effectively addressing the climate crisis.

- In business, I often find that as we focus on green practices, we drift away from business success—and vice versa. I refer to this conundrum as the green paradox. Had the carbon credit trading system been firmly established in Korea from the start, this issue might have been mitigated, but unfortunately, that hasn’t been the case.

- Consequently, I sometimes question whether the business models of companies that tout themselves as “green” can truly make a difference in combating the climate crisis. They likely began with a strict carbon credit-based, green approach, but when that model didn’t prove viable, they gradually compromised.

0 Resolving this paradox is incredibly challenging for a startup. It feels like from the very beginning, you’re burdened with a constant dilemma.

What Will Happen Anyway?

- How will climate policies unfold? I don’t know—the external environment is incredibly uncertain.

- The climate crisis is escalating at an alarming pace, with figures accelerating more and more.

- I wonder if, rather than creating a business that solves the climate crisis, we should be building one that helps people adapt and continue living on Earth even amid the crisis. I foresee that in about ten years, there will be a significant amount of land where human life becomes unsustainable.

- Will we need to live underground or beneath the sea? Should we develop extensive cooling systems?

Future Plans

- For now, I’ve set aside these concerns, but I intend to keep exploring and acting on climate-related challenges.

- My most important goal is to make money. I plan to raise 300000 USD to establish the foundation of my business.

- As I secure business funds, I will continue to study what’s necessary and advance technology development. I’m preparing for a winning game and will start over again.